“(T)he recommendation of government intervention does not follow from the demonstration that government intervention could improve matters.”

Gary Becker, Competition and Democracy (1958)1

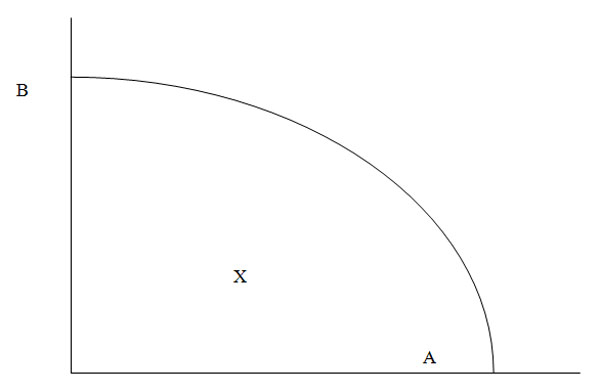

Coase argued as follows. In Figure 1 two e.g. traders or individuals, A and B, engaging in any kind of potential social relationship, are away from the efficiency frontier given their endowments, but will move instantly to the frontier if there are no transaction costs to trading, producing, voting, socializing, separating, contracting, renegotiating, or whatever. Figure 1: Coase Theorem

Where on the frontier will they end up? There are many optimal points on the frontier and even more compensated optima. Maybe they will be solving a Nash bargaining problem, maybe they will follow some other strategy. Transaction costs, e.g. procedures, formal or informal, may lead to the narrowing of feasible optima as they may also lead to inefficiencies of one kind or another. But without specifying the procedure, e.g. of trading, there is really no Coase theorem: the problem is underdetermined. The other way to say that is Debreu-Mantel-Sonnenschein theorem that any aggregate outcome is as probable as any other.

Now, does it matter from the macroeconomic point of view which point the society ends up at as long as it is the optimal one, e.g. one with full employment? For instance, we might say that in a closed economy public debt does not matter because the country owes the debt to itself. If we extend it to infinitely lived agents, it will not matter ever. In open economies and in models with overlapping generations that need not be the case. Still, in closed or open economies, it is not clear at what distribution the economy ends up settling. Again, there is any number of optimal distributions.

Let us, for the moment, assume that from a macroeconomic point of view, there is a relation of (social) indifference between all these optimal points: each is as good as another. For example, public debt we owe to ourselves, so it does not matter who is the debtor and who is the creditor and the debt and the cost of interest may be as high or as low as is needed. What would be the political procedure that would produce that indifference?

Let us say there is a benevolent dictator who can bring about full employment with zero transaction costs because of a clever incentive compatible and dynamically sustainable mechanism that has been designed. The dictator is benevolent because her aim is to bring the economy to full employment – that is to the efficiency frontier. She is a dictator because she is entrusted to set the terms of social transactions exclusively: prices, wages, interest rates, taxes.

She still needs to choose a distribution, one particular optimal point. How will she do that?

There is a reading list she could consult, e.g. starting with John Rawls, but it is quite long and inconclusive. There are at least two problems to solve: one is to have individuals do what they are best at (Plato’s problem) and the other is squaring that with social equality (Aristotle’s problem). That is a task from public finance: how to design the tax system and the system of transfers?

In order to do that, benevolent dictator needs to elicit information from the individuals and the society and aggregate them. One way is to rely on democratic elections and the competitive party system. Which brings up Rousseau’s problem: parties have preferences over the optimal points and general will, e.g. the particular full employment outcome needs to be chosen. The more general problem is that some non-optimal points may be preferable to some over a set of optimal points preferred by the others. Those could be the majority as well as the minority. So, neither the benevolent dictator nor democracy will be able to secure a move to the point that is both efficient and equitable. So, resources may be misallocated and rewards may not be justly distributed.

The argument does not depend on transaction costs or any specific assumption about decision making procedures. More often than not, in macroeconomics, once an argument is brought forth to the effect that it does not matter who owes what to whom because we owe it to ourselves, some homogenising assumption will be made, one or another type of a representative individual will rear his or her head. The criterion of homogenisation can be national, cultural, social or any one delineated by some border or another.

Keynes took a mixed approach. He assumed that Smith-Ricardo-Marshall classical market mechanism solves (i) the efficiency and (ii) distributional problem for the great majority of people (90 percent or more), but does not solve the problem of involuntary unemployment. So, one could conclude one assumes that the state should just take the wages as they are and employ those who are not employed at these going wages, taking care of their particular skills. That is, I think, he thought that policy mismanagement is due to ideological commitments rather than to genuine allocational and distributional problems because the Couase theorem works in the market, while in politics ideology brings in transaction costs as it were. This view of the functioning of the markets and politics Keynes did not extend across borders as is clear from his treatment of the German transfer problem.

References

D. Acemoglu (2003), “Why not a political Coase theorem? Social conflict, commitment, and politics”, Journal of Comparative Economics 31: 620-652.

G. Becker (1958), “Competition and Democracy”, Journal of Law and Economics 1: 105-109.

A. H. Meltzer, S. F. Richard (1981), “A Rational Theory of the Size of Government”, Journal of Political Economy 89: 914-927.

D. North (1990), “A Transaction Cost Theory of Politics”, Journal of Theoretical Politics 2: 355-367.

D. Wittman (1989), “Why Democracies Produce Efficient Results”, Journal of Political Economy 97: 1395-1424.

Peščanik.net, 28.07.2013.

________________

- Biografija

- Latest Posts

Latest posts by Vladimir Gligorov (see all)

- Kosmopolitizam je rešenje - 21/11/2022

- Oproštaj od Vladimira Gligorova - 10/11/2022

- Vladimir Gligorov, liberalni i nepristrasni posmatrač Balkana - 03/11/2022