The story of the Italian economy is, of course, a complex one, so here is just one argument why Italian governments were eager to adopt the euro and why going back to the lira is not very popular with the Italian public according to all we know.

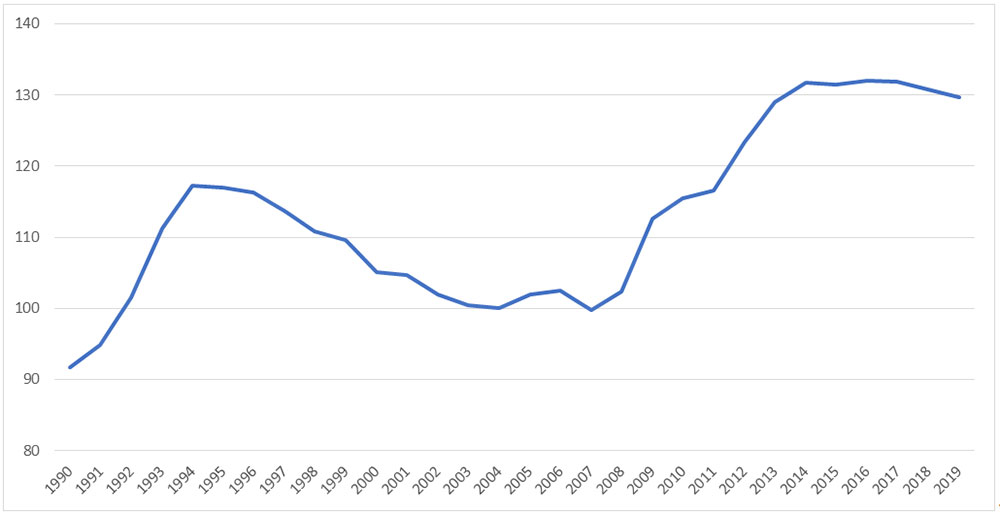

Figure 1 shows the development of public debt to GDP ratio since 1995. Clearly, it declined in the years up to the adoption of euro and until the crisis of 2008. The crisis, to remind ourselves, was not triggered by anything related to the common currency, but by the collapse of the financial system centred in New York. So, if public debt sustainability was a concern of the Italian authorities, adopting the euro seems to have provided a solution, at least based on the evidence of the public debt to GDP development.

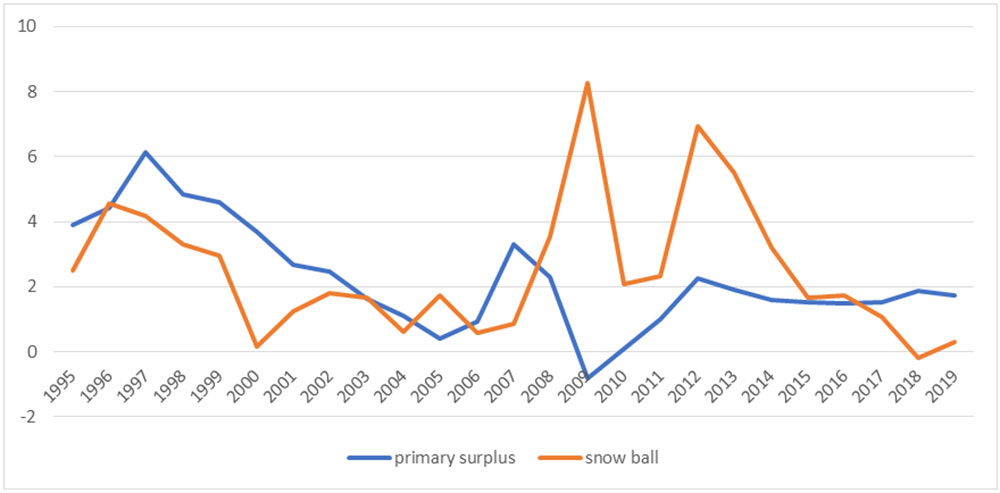

Figure 2 gives the history of the snowball effect on the public debt and of primary surpluses, also since 1995. The snowball effect is the difference between the rate of interest on the debt and the growth rate of GDP, while primary surplus is the difference between revenues and expenditures minus the interest on the debt. If the snowball effect is positive, interest rate being higher than the growth rate, i.e. it is contributing to growth of public debt, primary surplus is needed if the debt to GDP ratio is to stay at the same level.

We see in Figure 2 that the difference between the interest rate on the Italian public debt and the growth rate of the GDP went down significantly ahead of the adoption and after the adoption of the euro, and stayed low, relative to the lira years in any case, since the crisis, except for the initial year of the crisis and the year when the risk of collapse of the monetary union was elevated. It also remained significantly lower than in the lira years after the height of the crisis ended.

Therefore, the Italian government had to run much lower primary surpluses when it was relying on the euro than with its own lira. That means that with the adoption of the euro, fiscal policy could be significantly more relaxed than the lira-based monetary policy allowed.

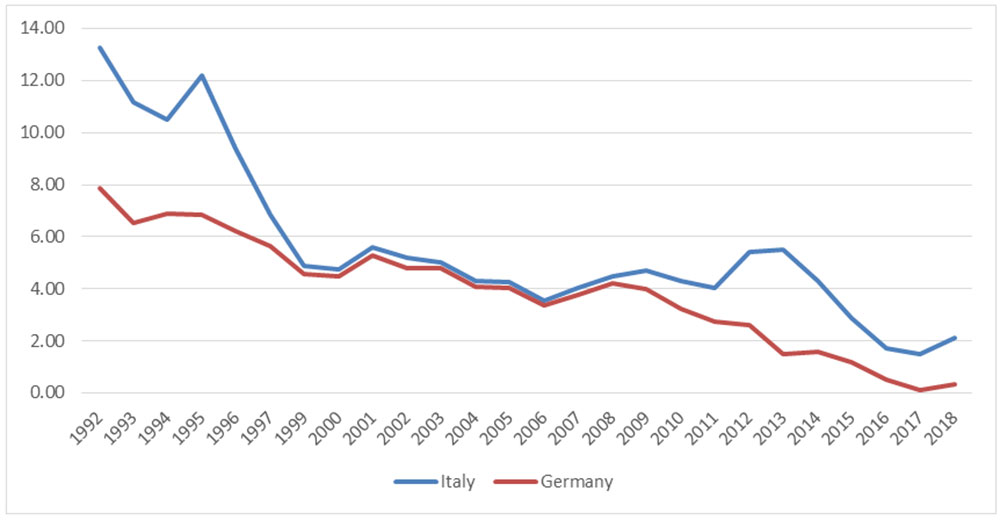

Another way to see the same is in Figure 3. The yield of the Italian 10-year government bonds came down practically to the German levels since the adoption of euro. The spread, the difference from the German benchmark, widened during the initial year of the crisis and also in 2011-2012, which are the years were risks of euro area disintegrated was the highest. The spread is widening now too in view of the growing probability that Italy will pull out of the monetary union.

Assume that the probability is just 10 percent now. That is on the assumption that it was about 25 percent in the crisis of 2012. At the moment of secession, and not considering initial overshooting, it might be up to 10 times more. That would be unsustainable, which implies that lira would have to devalue about 30 percent with similar inflationary effect (again disregarding initial overshooting and possible mismanagement with the probability of both being quite high). Financial and capital controls would have to be introduced with uncertain duration. Then, everything will depend on the other economic policy measures that the Italian government and the central bank would introduce. At the moment, there is hardly any idea what wold they look like.

So, that is what the Italian voters will have to consider in the upcoming elections.

I think that suggests an explanation for the popularity of the euro. Based on experience, if the lira were to be reintroduced, fiscal tightening would be needed. Or one of two other policies would have to be chosen.

Either public debt would have to be inflated away, at least that part which is owned by the Italians.

Or debt would have to be restructured.

In both cases, however, it is not clear that Italian fiscal authorities would indeed be able to significantly increase real fiscal spending, and it is rather probable that tighter fiscal policy would in fact be required.

So, staying with the euro seems like a better alternative even if the aim is to go for fiscal expansion to spur growth.

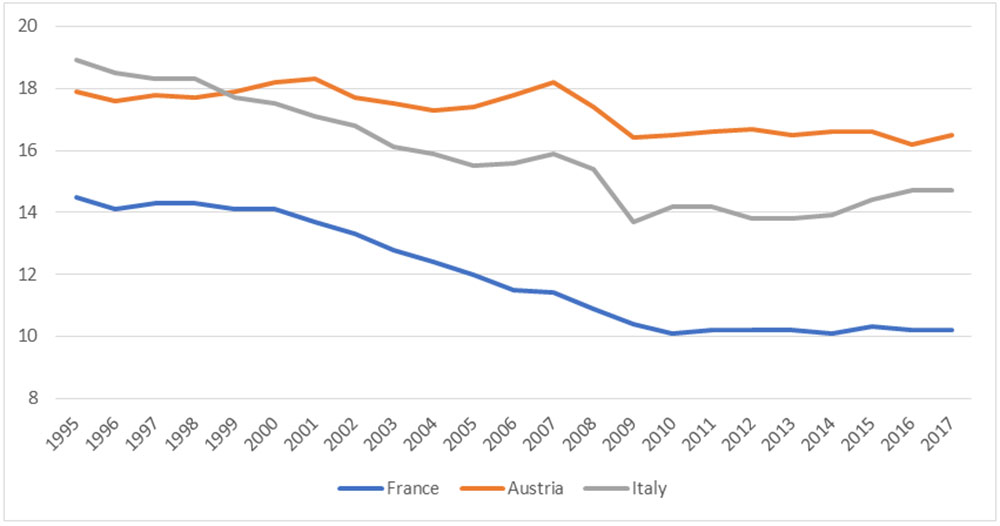

Figure 4 shows manufacturing value added as a share of GDP of Italy, France and Austria. There are other comparisons that one might want to make, but the message does not really change. Since 1995, industrial production has declined in all three countries, though in Austria the least. But it does not seem that anything out of the ordinary is taking place in Italy. In fact, within the more developed EU countries, Italy is closer to economies with significant manufacturing sectors. In any case, it would be very difficult to show that it was the adoption of the euro that caused or contributed to the deindustrialisation.

There is hardly any doubt that Italy has a problem of growth. Joining the euro has, if anything, helped, at least potentially, towards the solution of the problem as it has relaxed somewhat the rather tight fiscal constraint. That was squandered in the period before the 2008 crisis, and ditching the euro is not going to help. Which is why, on most accounts, going back to the lira appears not to command popular support.

Peščanik.net, 26.05.2018.

- Biografija

- Latest Posts

Latest posts by Vladimir Gligorov (see all)

- Kosmopolitizam je rešenje - 21/11/2022

- Oproštaj od Vladimira Gligorova - 10/11/2022

- Vladimir Gligorov, liberalni i nepristrasni posmatrač Balkana - 03/11/2022